Loading

Get Doa 6448 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Doa 6448 Form online

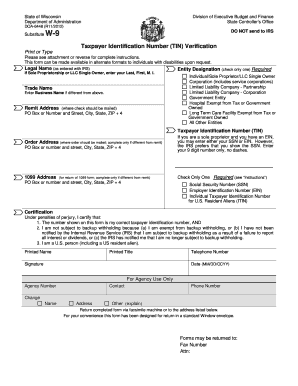

This guide provides essential instructions for filling out the Doa 6448 Form online. The Doa 6448 Form is used for Taxpayer Identification Number verification in accordance with IRS requirements, ensuring accurate processing of tax-related information.

Follow the steps to complete the Doa 6448 Form accurately.

- Click 'Get Form' button to download and open the Doa 6448 Form in your chosen document editor.

- Begin by entering your legal name exactly as it appears on your IRS records. If you are a sole proprietor or LLC single owner, include your Last, First, M. I.

- If different from your legal name, provide your trade name (business name).

- Fill out the remit address where payments should be mailed, including PO Box or street address, city, state, and ZIP + 4.

- Select your entity designation by checking the appropriate box that reflects your business type, ensuring only one option is selected.

- Provide your Taxpayer Identification Number (TIN) by selecting the appropriate identification type: Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

- If the order address is different from the remit address, include that information here.

- Complete the 1099 address section if it differs from your remit address.

- Review the certification section. By signing, you confirm the correctness of your TIN and acknowledge the backup withholding conditions.

- Enter your printed name, title, signature, telephone number, and the date of signing.

- For agency use, provide any necessary information related to agency number or contact details as required.

- Once all fields are complete, save your changes, and you can download, print, or share the form as needed.

Complete your Doa 6448 Form online today to ensure compliance and timely processing.

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.