Loading

Get Form M63, Amended Income Tax Return Payment - Minnesota ... - Revenue State Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M63, Amended Income Tax Return Payment - Minnesota online

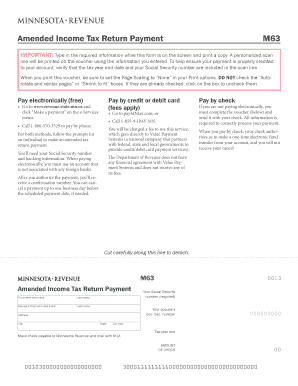

Filing an amended income tax return is an important task that ensures your tax records are accurate. This guide provides clear, step-by-step instructions on how to fill out the Form M63 online for the state of Minnesota.

Follow the steps to complete your amended income tax return payment form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your first name and initial, followed by your last name in the designated fields. If you are filing jointly, include your partner's first name and initial, along with their last name as well.

- Input your Social Security number in the required field. If filing a joint return, also provide your partner's Social Security number.

- Fill in your current address, including the city, state, and zip code, ensuring all information is accurate.

- Specify the last day of the tax year you are amending by entering it in the designated format (MMDDYY). For example, if amending for the tax year ending December 31, 2012, enter '123112'.

- Indicate the amount of your payment in the appropriate field.

- Carefully check that your Social Security number and your partner's (if applicable) are included in the scan line at the bottom of the form for proper payment crediting.

- Once all fields are filled, ensure the print settings are set to 'None' for Page Scaling before printing the voucher.

- You can choose to pay electronically or by check. If using electronic payment, follow the prompts for making a payment. For check payments, ensure you mail it along with the voucher.

- After authorizing your payment, remember to save changes, download, print, or share the form as needed.

Complete your amended income tax return payment form online today.

You can make payments for taxes and fees online, from your bank account, or in person. If you received a bill from the Minnesota Department of Revenue and cannot pay in full, you may request an installment plan. For more information, see Payment Agreements. You may make a payment directly from your bank account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.