Loading

Get Lf-5 - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LF-5 - State Of New Jersey - State Nj online

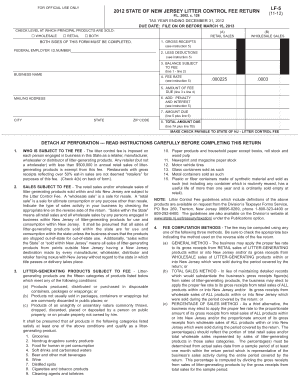

Filling out the LF-5 form for the State of New Jersey is essential for businesses subject to the litter control fee. This guide will help you navigate through each section of the form accurately and efficiently.

Follow the steps to complete the LF-5 form online.

- Press the ‘Get Form’ button to obtain the LF-5 form and open it in your preferred document editor.

- Fill in the tax year ending date, which will be December 31 for the applicable year. Ensure you enter the due date, which is March 15 of the following year.

- Indicate the level at which you sell your principal products by checking the appropriate box: wholesale, retail, or both.

- Enter your gross receipts from retail and wholesale sales of litter-generating products in the specified lines. Ensure these are whole dollar amounts only.

- Input any deductions applicable to your gross receipts, which may include sales to other wholesalers or distributors.

- Calculate the balance subject to the fee by subtracting the deductions from the gross receipts and enter the result on the indicated line.

- Select the fee rate based on your sales type and compute the amount of fee due by multiplying the balance subject to the fee by the fee rate.

- If applicable, add any penalties and interest to the fee due and calculate the total amount due.

- Complete the mailing address section, including business name, city, state, and zip code.

- Read and comply with all final instructions, then provide your signature, date, and the title of the authorized officer of the fee payer.

- Once completed, you can save the changes, download the form, print it, or share it with the necessary parties.

Ensure you complete your LF-5 form online and meet all filing requirements promptly.

New Jersey assesses a 6.625% Sales Tax on sales of most tangible personal property, specified digital products, and certain services unless specifically exempt under New Jersey law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.