Loading

Get Virginia Surplus Lines Form 801

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia Surplus Lines Form 801 online

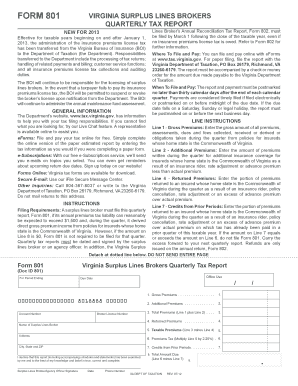

This guide provides clear and comprehensive instructions for filling out the Virginia Surplus Lines Form 801 online. Whether you are new to digital filing or have experience, this step-by-step guide will assist you in completing the form accurately and efficiently.

Follow the steps to fill out the Virginia Surplus Lines Form 801 online

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter the name of the surplus lines broker in the designated field. Ensure that the spelling is correct to avoid any issues during processing.

- Provide your broker license number in the specified area. This number is essential for identifying your account with the Virginia Department of Taxation.

- Input your account number. This should align with your records to ensure accurate tax reporting.

- In Line 1, enter the gross amount of all premiums collected during the quarter. This includes assessments, dues, and fees related to policies for insureds from Virginia.

- For Line 2, report any additional premiums written for coverage from insurance riders or rate adjustments relevant to Virginia insureds.

- On Line 4, indicate the amount of returned premiums to insureds based in Virginia during the quarter due to cancellations or adjustments.

- For Line 6, calculate the taxable premiums by subtracting Line 4 (returned premiums) from Line 3 (total premiums from Lines 1 and 2).

- Multiply the taxable premium amount from Line 5 by 2.25% to determine the premiums tax, which you will enter in Line 6.

- If applicable, report on Line 7 the credits from prior periods. Ensure this amount reflects previously paid taxes that are being accounted for.

- Finally, calculate the total amount due by subtracting Line 7 from Line 6 and fill this amount in Line 8.

- Sign and date the form to certify that all information provided is accurate to the best of your knowledge.

- Save changes to the form. You can download, print, or share the form as necessary to complete your filing.

Complete your Virginia Surplus Lines Form 801 online today for a seamless filing experience.

The 2022 Virginia State Income Tax Return for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed together with the IRS Income Tax Return by April 18, 2023. If you file a tax extension you can e-File your Taxes until October 15, 2023, and Nov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.