Loading

Get Texas Form Ap 231

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Form Ap 231 online

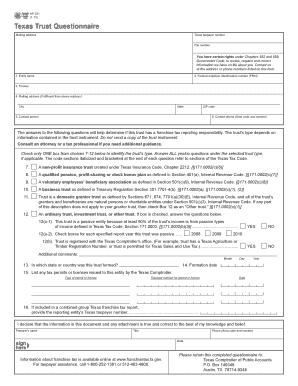

Filling out Texas Form Ap 231 is an essential step for trusts to determine their franchise tax reporting responsibilities. This guide provides a comprehensive overview and step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Texas Form Ap 231 online

- Press the ‘Get Form’ button to access the document and open it in the online editor.

- Begin by entering your mailing address at the top of the form. Ensure accuracy as this information will be used for all official correspondence.

- Fill in the Texas taxpayer number and file number where prompted. This information is crucial for identifying your tax account.

- In section 1, provide the name of the entity associated with the trust.

- Next, input the federal employer identification number (FEIN) in section 2.

- Identify the trustee in section 3 by entering their name.

- If the mailing address differs from the one provided at the top, fill in the new mailing address, city, state, and ZIP code in section 4.

- Provide the name of the contact person in section 5 and their phone number in section 6.

- Respond to the questions in section 7-12 regarding the trust's type. Select only one option that best describes the trust and answer any related yes/no questions.

- If you select option 12, ensure that you answer the additional questions regarding the trust's passive income and specific reporting years in sections 12(a-1) and 12(a-2).

- Indicate the state or country where the trust was formed in section 13.

- Enter the formation date of the trust in section 14.

- List any tax permits or licenses the trust has received from the Texas Comptroller in section 15.

- If the trust is included in a combined group Texas franchise tax report, provide the reporting entity's Texas taxpayer number in section 16.

- Lastly, ensure to declare the completeness and accuracy of the information by signing and dating the declaration at the bottom of the form.

- Review all entries for accuracy and completeness before saving your changes. You can then download, print, or share the completed form as needed.

Complete your Texas Form Ap 231 online today to ensure compliance with franchise tax obligations.

Related links form

Make sure the Texas Resale Certificate form is completely filled out – This includes the buyer's name and what they sell, your store name, and a detailed description of the items bought for resale. You should also have the buyer's address and signature.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.