Loading

Get Application For Disable Vetearn Property Tax Exemptions - State Sd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Disabled Veteran Property Tax Exemptions - State Sd online

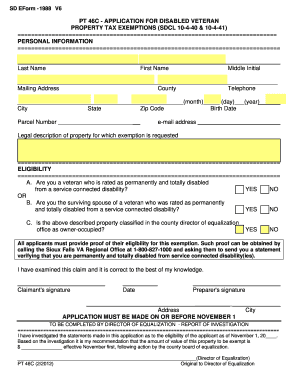

This guide provides detailed instructions on how to fill out the Application For Disabled Veteran Property Tax Exemptions for South Dakota online. The application is designed to help eligible veterans and their families benefit from property tax exemptions.

Follow the steps to complete the application accurately.

- Click the ‘Get Form’ button to obtain the application form and open it in your preferred editor.

- Begin filling out the personal information section, which includes your last name, first name, middle initial, mailing address, county, telephone number, birth date, and parcel number.

- Provide your email address and the legal description of the property for which you are requesting the exemption.

- In the eligibility section, indicate whether you are a veteran rated as permanently and totally disabled from a service-connected disability, the surviving spouse of such a veteran, or if the property is classified as owner-occupied by the county director of equalization.

- All applicants must provide proof of eligibility. You can obtain this verification by contacting the Sioux Falls VA Regional Office at 1-800-827-1000 and requesting a statement confirming your status.

- After completing the application, review the information to ensure it is accurate to the best of your knowledge. Sign the application with your claimant's signature and date.

- If someone else prepared the application, they should also provide their signature and address.

- Remember that the application must be submitted on or before November 1. Once completed, you can save changes, download, print, or share the form.

Start completing your application online today to ensure you receive the property tax exemption for which you are eligible.

On the chart below, the basic exemption amount for 2023 is $161,083, at a tax rate of 1.2% that is a savings of over $1,932 a year. However, the amount of the exemption may never exceed the assessed value of the claimant's residence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.