Loading

Get Ri Form 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Form 100 online

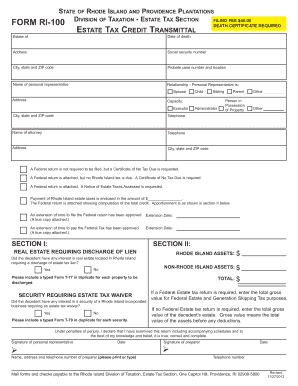

Filling out the Ri Form 100, the estate tax credit transmittal form for Rhode Island, can seem daunting. This guide will walk you through each step of the process to ensure accurate completion and submission.

Follow the steps to successfully complete the Ri Form 100 online.

- Press the 'Get Form' button to access the Ri Form 100 and open it in your preferred online editor.

- Begin by entering the estate name and the date of death of the individual, ensuring accurate information is provided to avoid any processing delays.

- Input the address, social security number, city, state, and ZIP code for the estate to keep all contact information clear and consistent.

- Fill in the probate case number and location, which are necessary for the processing of the estate matters.

- Provide the name of the personal representative and indicate their relationship to the deceased. Choose from options such as spouse, child, sibling, or other.

- Specify the capacity of the personal representative by selecting from the options: executor or administrator, and include their address and phone number.

- Enter the name and address of the attorney handling the estate, along with their telephone number for any inquiries regarding the form.

- Complete the section regarding federal returns, indicating whether a Certificate of No Tax Due is requested or if a federal return is attached.

- Fill out Section I and Section II, reporting Rhode Island and non-Rhode Island assets and whether a discharge of lien is required.

- Finally, ensure all signatures are complete before saving your changes. You may then download, print, or securely share the completed form as needed.

Complete your documents online today for a streamlined filing process.

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.