Loading

Get It 540 2d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-540-2D online

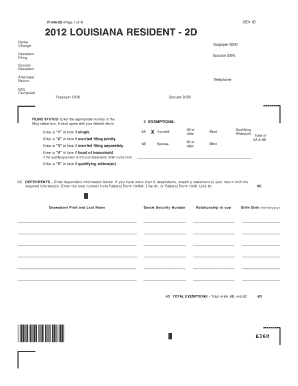

Filling out the IT-540-2D form online can simplify the process of submitting your Louisiana income tax return. This guide provides clear instructions and support to help you navigate each section of the form effectively.

Follow the steps to complete your IT-540-2D form online.

- Click ‘Get Form’ button to obtain the IT-540-2D form and open it for editing.

- Enter your personal information including your name, Social Security Number, and contact details in the designated fields.

- Select your filing status by entering the appropriate number in the filing status box; it should correspond with your federal return.

- Complete the exemptions section, indicating if you or your spouse are aged 65 or older or blind.

- Input your Federal Adjusted Gross Income in the appropriate line based on your federal tax documents.

- Calculate and enter the deductions from your federal returns, including whether you will use itemized or standard deductions.

- Provide details of any nonrefundable and refundable tax credits that apply to you.

- Review the sections for any payments withheld and enter the amounts accordingly.

- After completing all sections, save your changes, download the form, and print or share it as necessary.

Complete your IT-540-2D form online to ensure a smoother tax filing process.

Tax Year 2022 Filing Thresholds by Filing Status Self-employed individuals are required to file an annual return and pay estimated tax quarterly if they had net earnings from self-employment of $400 or more. Status as a dependent. A person who is claimed as a dependent may still have to file a return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.