Loading

Get Dt2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dt2 Form online

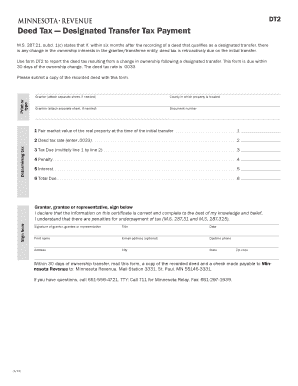

The Dt2 Form is essential for reporting deed tax due from a change in ownership following a designated transfer. This guide provides a step-by-step approach to effectively complete the form online, ensuring you meet all necessary requirements.

Follow the steps to accurately fill out the Dt2 Form online.

- Click ‘Get Form’ button to obtain the Dt2 Form and open it in your preferred editor.

- Complete the sections for the grantor and grantee by providing their respective details. If additional space is needed, attach a separate sheet.

- Indicate the county where the property is located.

- Input the document number pertaining to the deed.

- Enter the fair market value of the real property at the time of the initial transfer in the designated field.

- Insert the deed tax rate (0.0033) in the appropriate field.

- Calculate the tax due by multiplying the fair market value with the deed tax rate and record the result.

- If applicable, provide details for any penalty, interest, and total due in the respective fields.

- Ensure that the form is signed by the grantor, grantee, or their representative, including their title and date of signing.

- Include additional contact information like email, daytime phone number, and address, if required.

- Save your changes, and proceed to download, print, or share the form.

Complete your document filing online today for a seamless submission experience.

Minnesota Statute 287.21 provides for deed tax to be paid on deeds to be recorded. The rate is 0.0033 of the purchase price (Example: $105,250 X 0.0033 = $347.33 deed tax). The minimum deed tax amount is $1.65.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.