Loading

Get Minnesota Form M71

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Minnesota Form M71 online

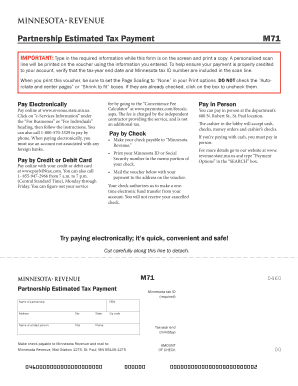

Filling out the Minnesota Form M71 for partnership estimated tax payments can be straightforward when you understand each step. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Minnesota Form M71 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the partnership in the designated field. Make sure to provide the full legal name as registered.

- Fill in the partnership's address, including the street address, city, state, and zip code.

- Input the name of the contact person associated with the partnership. This person should be reachable for any inquiries regarding the form.

- Provide the contact person's title within the partnership to clarify their role.

- Enter the Minnesota tax ID number in the required field. This is essential for processing the payment correctly.

- Fill in the Federal Employer Identification Number (FEIN) if applicable, ensuring it is accurate.

- Specify the last day of your tax year using the mmddyy format. This date applies to all four quarterly payments.

- In the 'Amount of Check' field, enter the total estimated tax payment for the quarter.

- Before printing the form, verify that the scan line includes the correct tax-year end date and Minnesota tax ID to ensure proper credit for your payment.

- Review all entered information for accuracy. Then save your changes, download, or print the form for submission.

Complete your Minnesota Form M71 online today for a seamless tax payment experience.

Local IRS Taxpayer Assistance Center (TAC) – The most common tax forms and instructions are available at local TACs in IRS offices throughout the country.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.