Loading

Get What Is Form Mn Pv43

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Form Mn Pv43 online

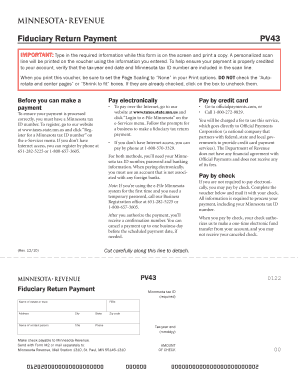

Filling out the What Is Form Mn Pv43 is essential for ensuring your fiduciary return payment is processed correctly. This guide will provide you with clear, step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the Minnesota tax ID number in the required field. This number is essential for processing and will be printed on the voucher.

- Fill in the name of the estate or trust. Make sure to enter the complete and correct name as it appears on official documents.

- Provide the address details, including the street address, city, state, and zip code. This information is crucial for correspondence regarding the payment.

- Enter the federal employer identification number (FEIN) if applicable. This number is used for identification and tax purposes.

- Indicate the last day of the tax year in the mmddyy format. Ensure accuracy to avoid payment issues.

- Fill in the name and contact details of the person managing the estate or trust, including their title and phone number for any necessary follow-up.

- Enter the amount of the check you are submitting. This is the total payment due and must be correct to ensure proper credit.

- Once all required fields are completed, verify the information entered in the scan line, ensuring it includes the correct tax-year end date and Minnesota tax ID.

- Review the entire form for accuracy and completeness, then proceed to save changes, download, print the form, or share it as needed.

Complete your paperwork now to ensure smooth processing of your fiduciary return payment.

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $4,000$0.00Over $4,000 but not over $32,0805.35% of excess over $4,000Over $32,080 but not over $96,230$1,502.28 plus 6.80% of excess over $32,0802 more rows • Mar 30, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.