Loading

Get Fr-500 (combined Registration With Sit & Sui) - Office Of Tax And ... - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FR-500 (combined Registration With SIT & SUI) - Office Of Tax And Revenue online

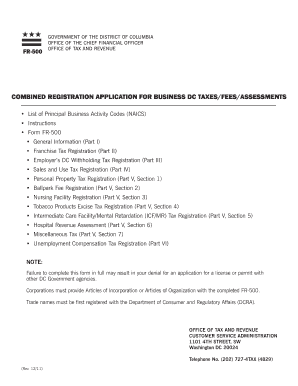

The FR-500 form is a combined registration application for business taxes and assessments in the District of Columbia. This guide provides step-by-step instructions to assist users in completing the form accurately and effectively while registering for various tax requirements online.

Follow the steps to complete the FR-500 form online.

- Select the ‘Get Form’ button to initiate the process and access the FR-500 form.

- Begin filling out Part I by entering your Federal Employer Identification Number and Social Security Number. If this information is not applicable, denote this with ‘N/A’.

- Input the NAICS Business Code that corresponds to your business activities. Refer to the list provided in the documentation for correct codes.

- Choose the reason for your application by checking the appropriate box. This may include options like ‘New business,’ ‘Address change,’ or ‘Purchased existing business.’

- Provide your business name, trade name (if different), business address (note that PO Box is not acceptable except in rural areas), and mailing address.

- Enter your local business phone number, main office phone number, and fax number if applicable. Ensure that each number is correctly formatted.

- Specify the date when your business began or is expected to commence operations in DC.

- List any previously registered name or business tax registration number, if applicable.

- In the section for principal officers or proprietors, enter their name, title, home address, and Social Security Number. Provide information for each relevant individual.

- Complete the sections related to tax registration according to the type of taxes applicable to your business, such as franchise tax, withholding tax, and sales/use tax, ensuring you check all relevant boxes.

- Confirm the accuracy of all entered information and ensure that the application is signed by the relevant parties, such as the owner or principal officer.

- Once completed, review the form for any inaccuracies, save your changes, and proceed to download or print the form for submission as required.

Complete your FR-500 registration online to ensure compliance with DC tax requirements and facilitate your business operations.

Related links form

On the MyTax.DC.gov homepage, locate the Business section. Click “Register a New Business – Form FR-500”. You will be navigated to our FR-500 New Business Registration Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.