Loading

Get Form 982 (rev. July 2013) - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 982 (Rev. July 2013) - Internal Revenue Service - Irs online

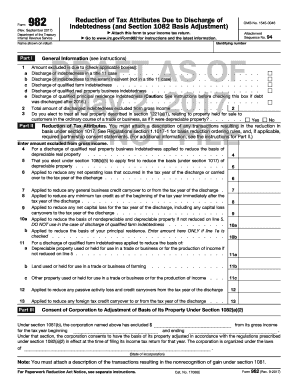

Filling out the Form 982 is an essential process for individuals seeking to report the reduction of tax attributes due to the discharge of indebtedness. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete Form 982 effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing platform.

- Begin filling out the identifying information section. This includes entering your name as it appears on your tax return and the corresponding identifying number.

- In Part I, indicate the reasons for the exclusion from gross income by checking the applicable boxes regarding the discharge of indebtedness. Ensure to provide accurate selections based on your situation.

- Document the total amount of the discharged indebtedness excluded from gross income in the specified field.

- Move to Part II and fill in the necessary sections that apply to reducing the basis of various types of properties. Provide information relevant to your situation and ensure any election statements are complete.

- Complete Part III by entering the amounts and descriptions as required, particularly for any transactions resulting in basis reductions under section 1017.

- After completing the form, review any instructions carefully to ensure all required fields are filled accurately.

- Once satisfied with the form, you can save your changes, download the completed form, print it for your records, or share it as necessary.

Start filling out your Form 982 online today for effective tax attribute management.

Generally, you must file a claim for a credit or refund within three years from the date you filed your original tax return or two years from the date you paid the tax, whichever is later.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.