Loading

Get 1099-r Correction Request Form - Um Infopoint - Uminfopoint Umsystem

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099-R Correction Request Form - UM InfoPoint - Uminfopoint Umsystem online

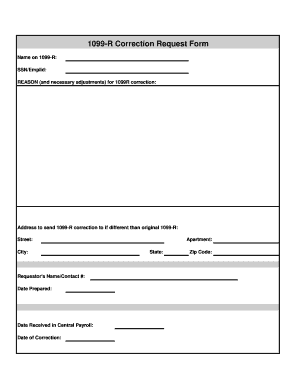

Filling out the 1099-R Correction Request Form is essential for correcting any inaccuracies in your tax information. This guide provides clear, step-by-step instructions to assist you in completing the form online accurately and efficiently.

Follow the steps to complete the 1099-R Correction Request Form.

- Press the ‘Get Form’ button to access and open the 1099-R Correction Request Form in your document editor.

- In the 'Name on 1099-R' field, enter your full name as it appears on the original 1099-R form.

- Input your Social Security Number or Employee ID in the 'SSN/Emplid' section to identify your records.

- Specify the reason for the correction in the 'REASON (and necessary adjustments) for 1099R correction' section, detailing any changes that need to be made.

- If your address for sending the corrected 1099-R differs from the original, fill in the 'Address to send 1099-R correction to' section, including Street, City, State, and Zip Code.

- Provide your name and contact number in the 'Requestor's Name/Contact #' section for follow-up communication.

- Fill in the 'Date Prepared' field with the date you are completing this correction request.

- Leave the 'Date Received in Central Payroll' and 'Date of Correction' sections blank; they will be filled out by the payroll department upon processing.

- Review all entries carefully to ensure accuracy, then choose to save your changes, download a copy, print the form, or share it as necessary.

Complete your 1099-R Correction Request Form online today to ensure your tax information is accurate.

If you do not receive your Form W-2 or Form 1099-R by January 31st , or your information is incorrect, contact your employer/payer. If you do not receive the missing or corrected form by February 14th from your employer/payer, you may call the IRS at 1-800-829-1040 for assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.