Loading

Get To Open Pdf Version Of The W-9 Form Page 1 - Business And ... - Www-bfs Ucsd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the To Open Pdf Version Of The W-9 Form Page 1 - Business And ... - Www-bfs Ucsd online

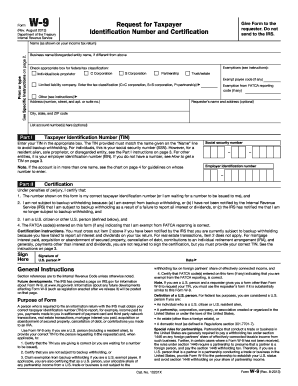

The W-9 form is crucial for individuals and entities needing to provide their taxpayer identification number to maintain compliance with tax regulations. This guide will equip you with step-by-step instructions to effectively complete the W-9 form online.

Follow the steps to fill out the W-9 form smoothly.

- Press the ‘Get Form’ button to obtain the W-9 form and access it in an editable format.

- Enter your name as it appears on your income tax return in the designated field at the top of the form.

- If applicable, provide your business name or disregarded entity name in the corresponding field.

- Select the appropriate federal tax classification by marking the relevant box (e.g., Individual/sole proprietor, C Corporation, S Corporation, Partnership, Trust/estate). If you are a limited liability company, specify the tax classification.

- Fill out your address, including the street number, suite number, city, state, and ZIP code in the respective sections.

- In Part I, provide your taxpayer identification number (TIN). This is your social security number for individuals or your employer identification number for entities. Ensure that the TIN corresponds with the name entered previously.

- Proceed to Part II and read the certification statement carefully. Ensure you understand your obligations as you sign this section.

- Complete the certification by signing and dating the form, confirming that all information provided is accurate.

- Review the completed form for accuracy, save your changes, and choose to download, print, or share the form as necessary.

Start filling out your W-9 form online today to ensure compliance and streamline your tax filings.

Where can I get a blank w9 form? You may also get this form by calling 1-800-772-1213. Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.