Loading

Get Is Dependent Temple Undergraduate Tuition Remission Taxable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Is Dependent Temple Undergraduate Tuition Remission Taxable Form online

Completing the Is Dependent Temple Undergraduate Tuition Remission Taxable Form is essential for ensuring that you receive the appropriate tuition benefits. This guide will provide you with detailed, step-by-step instructions to help you fill out the form accurately online.

Follow the steps to complete the form with ease.

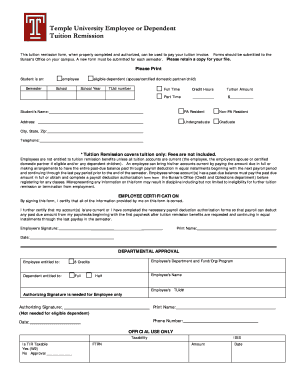

- Press the ‘Get Form’ button to access the form and open it for editing.

- Indicate whether the student is an employee or an eligible dependent, such as a spouse, certified domestic partner, or child. Make sure to check the correct box.

- Enter the semester and academic year in the appropriate fields to ensure accurate processing.

- Fill in the student's TUid number, which is necessary for identifying the accounts.

- Specify enrollment status by indicating full-time or part-time status, and enter the corresponding credit hours.

- Input the tuition amount under the appropriate section, noting that tuition remission only covers tuition and does not include fees.

- Provide the student’s name, address, city, state, zip code, and telephone number to ensure proper identification and communication.

- Confirm residency status by checking either PA resident or non-PA resident.

- Review the employee certification section carefully. The employee must sign and print their name and date, certifying that all information is correct and that their account is current.

- If applicable, have the department approve the form by obtaining the necessary authorizing signature from the appropriate department representative.

- Finally, once all fields are complete and reviewed, save your changes, and download, print, or share the form as necessary.

Start filling out the Is Dependent Temple Undergraduate Tuition Remission Taxable Form online now to ensure your tuition benefits.

Many employers offer tuition reimbursement, which means you (the employee) pays upfront, and if you meet the conditions attached to reimbursement, the employer will pay you back. Typically, there is a cap of $5,250 per year. Tuition remission means that your employer helps to finance your education.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.