Loading

Get Lst Exemption Certificate Form - Slippery Rock University

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LST Exemption Certificate Form - Slippery Rock University online

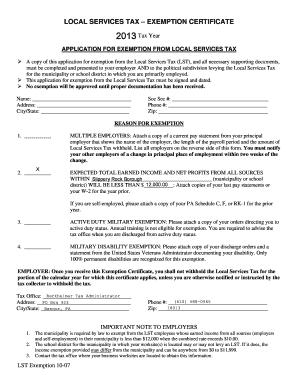

The LST Exemption Certificate Form allows users to apply for an exemption from the Local Services Tax required by certain municipalities. This guide provides clear, step-by-step instructions for completing the form online, ensuring a smooth submission process.

Follow the steps to fill out the LST Exemption Certificate Form online

- Click the ‘Get Form’ button to access the LST Exemption Certificate Form. This will open the document in an online editor for you to complete.

- In the first section, input your personal details. Enter your full name, address, city, state, phone number, and zip code in the designated fields.

- Indicate your reason for exemption by selecting from the options provided. Fill in the relevant sections based on your specific situation.

- If applicable, list any multiple employers. Attach a current pay statement from your primary employer showing the necessary details regarding Local Services Tax withheld.

- In the section for expected total earned income and net profits, specify the applicable municipality or school district and enter an amount that will be less than the specified threshold.

- If claiming exemption due to active duty military service or military disability, ensure to attach the required documentation, such as orders or discharge statements.

- Review all information for accuracy and completeness. Once confirmed, provide your signature and date in the designated area.

- Finally, save any changes made to the document. You may also choose to download, print, or share the completed form as needed.

Start completing your LST Exemption Certificate Form online today to ensure timely processing of your exemption.

Question: Why is there an amount in Box 14 on my Form W-2? Answer: Box 14 data was added for informational purposes and represents the total amount of Local Services Tax, Occupational Privilege Tax, Taxable Vehicle, Imputed Income for Flexible Spending Account (FSA) and/or Health Reimbursement Arrangement (HRA).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.