Loading

Get Rc240

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc240 online

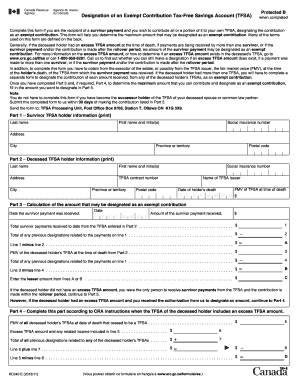

Filling out the Rc240 form is an important step for individuals receiving survivor payments who wish to designate a portion of these payments as exempt contributions to their tax-free savings account (TFSA). This guide provides a step-by-step overview to assist you in completing the form accurately.

Follow the steps to complete the Rc240 form successfully.

- Click the ‘Get Form’ button to obtain the Rc240 form and open it in your editor.

- Begin by filling out Part 1, which includes survivor TFSA holder information. Provide your last name, first name and initials, social insurance number, address, city, province or territory, and postal code.

- Move to Part 2 and enter the deceased TFSA holder's information. This section requires the last name, first name and initials, address, TFSA contract number, city, province or territory, social insurance number, name of the TFSA issuer, postal code, the fair market value (FMV) of the TFSA at the time of death, and the date of the holder's death.

- Proceed to Part 3 to calculate the amount that may be designated as an exempt contribution. Fill in the date the survivor payment was received, the amount of the survivor payment received, and complete the calculations specified to determine the maximum eligible contributions to designate.

- If applicable, complete Part 4 regarding an excess TFSA amount as per CRA instructions. List the FMV of all deceased holder's TFSAs at the date of death and calculate any excess TFSA amount.

- Complete Part 5, where you will designate the amount as an exempt contribution to the TFSA. Enter the amounts, dates, and survivor TFSA contract numbers for each contribution you wish to designate.

- Finally, certify the information by signing and dating the form. Include your telephone number for any necessary follow-up.

- Review your completed form thoroughly, save any changes, and prepare to submit it. You can download, print, or share the completed form as needed.

Start filling out your Rc240 form online today to ensure your contributions are correctly designated.

The annual TFSA dollar limit for the year 2023 is $6,500. The annual TFSA dollar limit for the years 2019 to 2022 was $6,000. The annual TFSA dollar limit for the years 2016 to 2018 was $5,500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.