Loading

Get Rc199

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc199 online

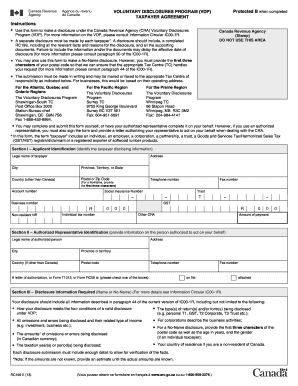

Filling out the Rc199 form is a crucial step in making a voluntary disclosure to the Canada Revenue Agency. This guide will provide you with detailed, step-by-step instructions on how to complete the form accurately.

Follow the steps to complete the Rc199 online effectively.

- Click ‘Get Form’ button to obtain the Rc199 form and open it in the online editor.

- In Section I, fill out the applicant identification. Provide your legal name, address, city, province or territory, postal or zip code, and telephone number. If you are making a No-Name disclosure, include the first three characters of your postal code.

- Complete any necessary identifying information, such as your account number, social insurance number, or business number if applicable. Ensure all information is accurate and complete.

- In Section II, provide the information of your authorized representative, if applicable. This includes their legal name, address, and contact details. Indicate whether a letter of authorization is on file or attached.

- Move to Section III, where you will outline the disclosure information. Clearly state how your disclosure meets the four conditions of the Voluntary Disclosures Program. Include details on the types of returns being disclosed, any omissions or errors, and amounts involved.

- In Section IV, detail the reasons for your disclosure. If more space is needed, attach a separate sheet.

- Complete Section V by signing as the taxpayer or as the authorized representative, if applicable. Ensure the declaration accurately reflects the truthfulness of your submission.

- Once you have filled out the form, review all sections for accuracy and completeness. Finally, save your changes. You can download, print, or share the completed form as needed.

Start your online submission of the Rc199 form today to ensure a smooth voluntary disclosure process.

The CRA's Voluntary Disclosures Program provides taxpayers with the chance to correct their tax affairs in order to comply with Canadian tax law. When a taxpayer wants to make a voluntary disclosure with the CRA, he or shed must sign Form RC199, Voluntary Disclosures Program (VDP) Taxpayer Agreement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.