Loading

Get Gst498 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst498 form online

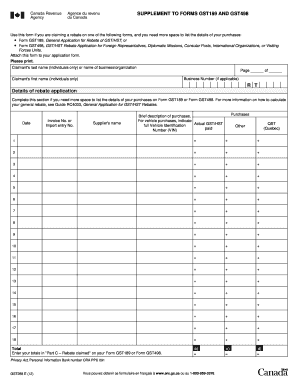

Filing the Gst498 form online can streamline the process of applying for GST/HST rebates as a foreign representative, diplomatic mission, consular post, or international organization. This guide provides comprehensive, step-by-step instructions to ensure you accurately complete the form.

Follow the steps to effectively complete the Gst498 form online.

- Press the ‘Get Form’ button to access the Gst498 form and open it in the digital editor.

- Begin filling out the claimant's details by entering your last name or the name of your business or organization in the designated field.

- Input the claimant's first name in the corresponding section if applicable.

- Provide your Business Number if you have one; if not, you can skip this step.

- In the 'Details of rebate application' section, include each purchase you are claiming a rebate for. Start by entering the date of each purchase.

- For each purchase, record the invoice number or import entry number. This allows for tracking of your transactions.

- Input the supplier's name for each applicable transaction in the corresponding field.

- Describe the purchases briefly, ensuring clarity about what each purchase involved.

- If any purchases involve vehicles, enter the full Vehicle Identification Number (VIN) in the appropriate space.

- Fill in the Actual GST/HST paid for each purchase in the designated field.

- If applicable, enter the QST amount for purchases made in Quebec.

- Complete the 'Other' section if there are additional costs related to your purchases.

- Continue adding details for up to 42 purchases, ensuring all relevant information is captured.

- Once you have listed all necessary transactions, calculate the total amounts and enter these figures in the 'Total' section.

- Transfer the totals to 'Part C – Rebate claimed' on your Form GST498 to ensure all figures match.

- After completing all sections, you can save your changes, download the filled form, and print or share it as needed.

Start your application by completing the Gst498 form online today.

The tour operator can claim a rebate equal to $390 (HST paid for the short-term accommodation). To claim your rebate, use Form GST115, GST/HST Rebate Application for Tour Packages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.