Loading

Get Office Of The Registrar University System Of Georgia (usg) Employees And Dependents Waiver

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Office Of The Registrar University System Of Georgia (USG) Employees And Dependents Waiver online

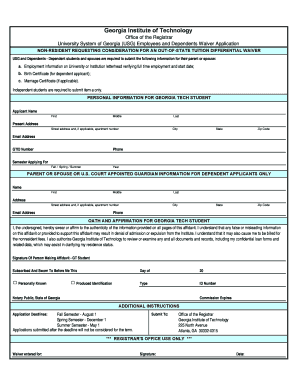

Completing the Office Of The Registrar University System Of Georgia (USG) Employees And Dependents Waiver is an essential process for employees and their dependents seeking a tuition differential waiver. This guide provides clear instructions on how to fill out the form accurately and efficiently, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the waiver application.

- Click ‘Get Form’ button to obtain the waiver application and open it in your preferred document editor.

- Begin by filling out the personal information section for the Georgia Tech student. Include your first, middle, and last name, present address, email address, Georgia Tech Identification Number (GTID), and phone number.

- Indicate the semester for which you are applying. Choose from Fall, Spring, or Summer and provide the corresponding year.

- If you are applying as a dependent, provide the name, address, email address, and phone number of your parent, spouse, or U.S. court-appointed guardian. Ensure this information is complete and accurate.

- Review the oath and affirmation section. You must swear or affirm that the information provided is true and accurate. Sign and date the form in the designated area.

- If applicable, gather the required documentation, including employment verification on institutional letterhead and any birth or marriage certificates for dependent applicants.

- Ensure you have all necessary documents, then review the completed form for accuracy. Save your changes.

- Finally, you may download, print, or share the form as needed. Submit the completed waiver application to the Office of the Registrar at Georgia Institute of Technology before the application deadline.

Take the first step towards securing your tuition waiver by completing the application online today.

An employee must receive a grade of C or better in each approved Tuition Assistance Program academic course. TAP participants are allowed up $5250 annually in “tax free” educational assistance benefits. Employees generally pay taxes on benefits in excess of the annual $5250.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.