Loading

Get Alien Information Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alien Information Request Form online

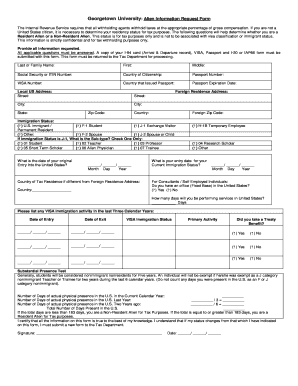

Filling out the Alien Information Request Form is an essential step for individuals who are not United States citizens to determine their tax status. This guide provides comprehensive instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Provide your last or family name, first name, and middle name as required. Make sure to enter these names as they appear on your official documents.

- Enter your social security number or ITIN number if applicable. This information helps in identifying your tax obligations.

- Indicate your country of citizenship accurately. This is essential for tax classification purposes.

- List your passport number and the country that issued your passport. Ensure this information is up-to-date and correct.

- Fill in the passport expiration date to ensure validity of your travel documentation.

- Input your local U.S. address, including street details, city, state, and zip code.

- Provide your foreign residence address, including city, country, and zip code. This distinguishes your permanent residence.

- Select your immigration status from the options provided, and if applicable, specify the subtype for those with a J-1 status.

- Record the date of your original entry into the United States. Use the format: Month/Day/Year.

- State your country of tax residence if it differs from your foreign residence address.

- Enter the current immigration status entry date using the same date format as outlined previously.

- For consultants or self-employed individuals, indicate whether you have an office in the U.S. and how many days you will be performing services in the country.

- List any visa immigration activity from the last three calendar years by providing entry and exit dates, visa status, and primary activity.

- Complete the Substantial Presence Test section by counting the days present in the U.S. and calculating the totals as instructed.

- Certify that all information provided is true and sign the form. Also, include the date of signing.

- Once you have filled out all sections, review your entries for accuracy, and then save your changes. You can download, print, or share the completed form as needed.

Complete your Alien Information Request Form online today to ensure compliance with tax regulations.

You are a resident alien of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year. In some cases, aliens can choose to be treated as U.S. resident aliens.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.