Get Employee Mileage Log Form - Compass - Compass Emory

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EMPLOYEE MILEAGE LOG FORM - Compass - Compass Emory online

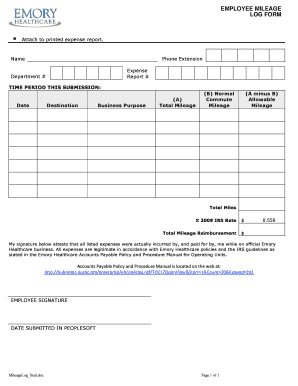

Filling out the employee mileage log form is an essential task for documenting business travel expenses. This guide provides clear, step-by-step instructions on how to properly complete the form online, ensuring compliance with organizational policies and IRS guidelines.

Follow the steps to complete the employee mileage log form online.

- Click the ‘Get Form’ button to access the employee mileage log form and open it in your preferred editing tool.

- Enter your name in the designated field to identify who is submitting the mileage.

- Input your phone extension, allowing for easy communication regarding any inquiries.

- Fill in the expense report number, linking this mileage submission to your expense activities.

- Provide your department number to categorize the log under the appropriate organizational unit.

- Specify the time period for this submission by entering the start and end dates of travel.

- For each trip, note the destination where the business was conducted.

- Describe the business purpose of the travel succinctly to justify the mileage claim.

- Record the total mileage traveled during the trips under the Total Mileage section (A).

- Document any normal commute mileage in the corresponding section (B) to differentiate between regular travel and business-related mileage.

- Calculate the allowable mileage by subtracting the normal commute mileage (B) from the total mileage (A) and enter it in the Allowable Mileage section.

- Multiply the allowable mileage by the 2009 IRS rate of $0.550 to determine the total mileage reimbursement.

- Sign and date the form to confirm that all expenses were incurred in accordance with Emory Healthcare policies.

- Once completed, save any changes made to the form. You may also download, print, or share the form as necessary.

Complete your employee mileage log form online today and ensure timely reimbursement for your travel expenses.

For manual mileage tracking, create a detailed log using a notebook or spreadsheet, recording trip specifics like date, locations, miles, and purpose. Note odometer readings, keep receipts for expenses, and regularly update for accuracy. How to Track Mileage for Work & Why You Should - Roll by ADP rollbyadp.com https://.rollbyadp.com › blog › grow-your-business rollbyadp.com https://.rollbyadp.com › blog › grow-your-business

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.