Loading

Get Vrs Refund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vrs Refund online

Filling out the Vrs Refund form can be a straightforward process with the right guidance. This guide will walk you through each section of the form, ensuring that you understand what information is required to successfully submit your refund request online.

Follow the steps to complete the Vrs Refund form online.

- Press the ‘Get Form’ button to access the Vrs Refund form and open it in your chosen editor.

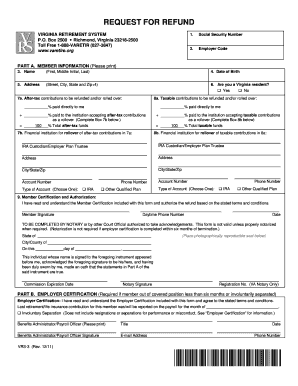

- Input your Social Security number and personal information in Boxes 1-5. Ensure this information is accurate to avoid delays in processing your refund.

- In Box 6, indicate whether you are a Virginia resident by selecting 'Yes' or 'No'. This is important for tax withholding purposes.

- In Box 7a, specify the percentage of your after-tax contributions you wish to be paid directly to you or rolled over. Enter the appropriate percentages that total 100%.

- In Box 8a, similarly define the percentage of taxable contributions for direct payment or rollover, ensuring that these percentages also total 100%.

- For Boxes 7b and 8b, provide the financial institution details where your after-tax and taxable contributions will be rolled over, respectively.

- In Box 9, carefully read the Member Certification and, if you agree to the terms, sign and date the form. If applicable, get your employer to complete Part B, or have your signature notarized.

- Finalize your application by submitting the completed form directly to VRS or your employer, depending on your situation. Ensure all signatures are original as copies are not accepted.

- After submission, you may save, download, or print a copy of the completed form for your records.

Begin your Vrs Refund application online today to ensure a smooth refund process.

Vesting is the minimum length of service you need to qualify for a future retirement benefit. You become vested when you have at least five years (60 months) of service credit. Vesting means you are eligible to qualify for retirement if you meet the age and service requirements for your plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.