Loading

Get Form 8879 Vt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8879 Vt online

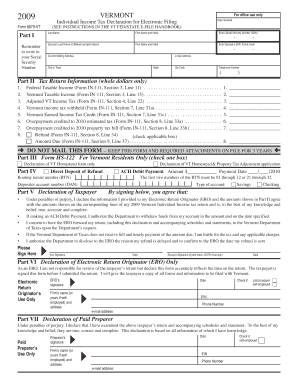

Filling out Form 8879 Vt is an essential step for users preparing their Vermont individual income tax returns electronically. This guide provides a detailed, step-by-step approach to completing the form to ensure all pertinent information is captured accurately.

Follow the steps to properly complete your Form 8879 Vt online.

- Click the ‘Get Form’ button to access the form and open it in your preferred document editor.

- In Part I, begin by entering your last name, first name, and initial in the appropriate fields. This helps to identify your tax records accurately.

- Next, input your Social Security Number (SSN) in the designated field. If you are filing a joint return, provide your spouse's last name, first name, initial, and their SSN.

- Fill in your current mailing address, including your city or town, state, and zip code. Ensure that this information is current to receive any correspondence related to your tax return.

- Include your email address and telephone number, as these may be used for communication regarding your submission.

- Proceed to Part II, where you will enter tax return information in whole dollars only. Fill in the fields for Federal Taxable Income, Vermont Taxable Income, and other specified amounts, referring to the associated lines from Form IN-111.

- Once you have completed the income and tax information, check the box for whether you wish to authorize a direct deposit of your refund and provide your routing transit number and account number, specifying if it is a savings or checking account.

- In the declaration section, read the statements carefully. After understanding the declarations, sign and date the form as required. If filing jointly, ensure your spouse also signs and dates the form.

- Finally, review all entered information for accuracy. Once confirmed, you can save your changes, download the form, print it if necessary, or share it as required.

Complete your Form 8879 Vt online quickly and efficiently today.

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.