Loading

Get Vermont Department Of Taxes Technical Bulletin - State Vt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VERMONT DEPARTMENT OF TAXES TECHNICAL BULLETIN - State Vt online

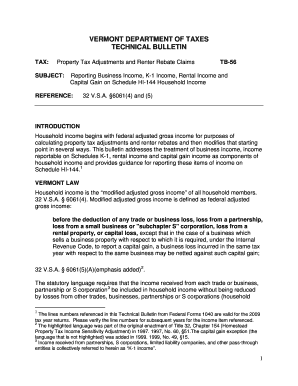

Filling out the Vermont Department of Taxes Technical Bulletin is an important step for individuals and businesses seeking property tax adjustments and renter rebate claims. This guide will provide you with a clear, step-by-step approach to complete the form accurately online, ensuring that you meet all necessary requirements.

Follow the steps to accurately complete the Technical Bulletin online.

- Press the ‘Get Form’ button to obtain the Technical Bulletin form and open it as needed in your document editor.

- Begin by entering your personal information in the designated fields, including your name, address, and any relevant identification numbers.

- Proceed to report your household income by including all sources of income, ensuring to list each business and rental property income separately as instructed.

- Refer to the Federal Form 1040 to find line items relevant to your reported income and fill them into Schedule HI-144 accordingly.

- For any losses incurred from your businesses or rental properties, ensure not to offset these against income from other sources unless specified as allowable.

- Complete all other requisite fields as directed by the form, ensuring accuracy in your calculations and the information provided.

- Once you have filled out the Technical Bulletin, review all entries for accuracy and completeness.

- After confirming that all information is correct, save your changes. You may then download, print, or share the completed form as needed.

Start filling out your Technical Bulletin online today to ensure you meet your tax obligations!

Here are some other places you might find the amount of last year's state/local refund: Last year's state tax return. Your bank statement showing your entire state/locality refund. Your state tax agency (for state refunds) or municipality (for local refunds)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.