Loading

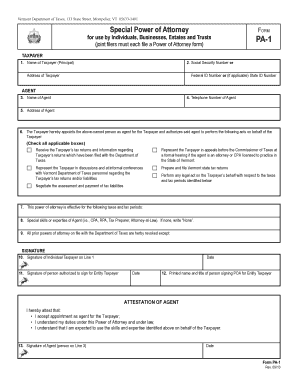

Get Instructions For Vt Form Pa-1 - State Vt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Vt Form Pa-1 - State Vt online

Filling out the Instructions For Vt Form Pa-1 is an important step for individuals, businesses, estates, and trusts wishing to designate an agent for tax purposes. This guide provides clear, step-by-step instructions to ensure users can complete the form accurately and efficiently online.

Follow the steps to complete your form smoothly.

- Click ‘Get Form’ button to access the Special Power of Attorney form and open it in your preferred editor.

- In the Taxpayer section, enter the full name of the individual or entity appointing the agent as well as their address.

- Input the Social Security Number for individuals or the Federal ID Number/State ID Number for entities in the designated field.

- Provide the name of the Agent in the respective section.

- Enter the telephone number of the Agent for contact purposes.

- Fill in the address of the Agent clearly to ensure proper correspondence.

- Check all applicable boxes to confirm the powers being granted to the Agent, including authorization to receive tax information, represent the Taxpayer, negotiate tax liabilities, prepare tax returns, or perform legal actions on behalf of the Taxpayer.

- Specify the types of taxes (e.g., income tax) and the corresponding tax periods (e.g., 2022) the Agent is authorized to act on behalf of the Taxpayer. If applicable to all, simply write 'ALL'.

- Indicate any special skills or expertise of the Agent, such as being a CPA or attorney. If there are none, write 'NONE'.

- If the Taxpayer is an individual, they should sign on the designated line. For entity Taxpayers, the authorized person must sign in the appropriate section.

- Print the name and title of the person signing on behalf of the entity Taxpayer, ensuring clarity.

- The Agent must then sign and date the form to affirm their appointment and understanding of their duties under the Power of Attorney.

- Once completed, review all entries for accuracy, then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure a smooth filing process.

Print the last four digits of your SSN or taxpayer ID number and 2023 IT‑2105 on your payment. Make payable to NYS Income Tax. Mail voucher and payment to: NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY 13902-4122.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.