Loading

Get Tc 40d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 40d online

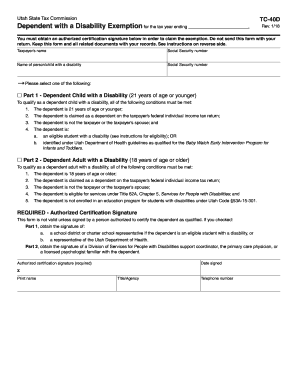

Filling out the Tc 40d form is essential for taxpayers claiming an exemption for a dependent with a disability. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the Tc 40d form online.

- Press the ‘Get Form’ button to access the Tc 40d form and open it in your preferred online platform.

- Begin by entering the taxpayer's name in the designated field.

- Input the taxpayer's Social Security number in the corresponding section.

- Next, provide the name of the person with a disability in the appropriate field.

- Enter the Social Security number of the individual with a disability.

- Select either Part 1 or Part 2, depending on whether the dependent is a child or adult with a disability. Ensure you meet all the qualifying conditions outlined for the selected part.

- Complete the required fields under the chosen part, ensuring all conditions and requirements for certification are met.

- Obtain the necessary authorized certification signature, either from a designated representative or a certified professional, based on selection.

- Finally, after reviewing the completed form, save your changes, and choose to download, print, or share the form as needed.

Start filling out your form online today to ensure you secure the dependent with a disability exemption.

Related links form

In Texas, a disabled adult has a right to a special homestead exemption. If you qualify, this exemption can reduce your taxes substantially. By law, school districts must provide a $10,000 disability exemption. Other taxing entities have the option to offer disability exemptions of at least $3,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.