Loading

Get Application For Plug-in Hybrid Vehicle Credit 20 - Sctax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR PLUG-IN HYBRID VEHICLE CREDIT 20 - Sctax online

This guide will help you navigate the APPLICATION FOR PLUG-IN HYBRID VEHICLE CREDIT 20 - Sctax, ensuring you complete the form accurately and efficiently. By following these steps, you will be able to fill the application out online with ease.

Follow the steps to complete the application successfully.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

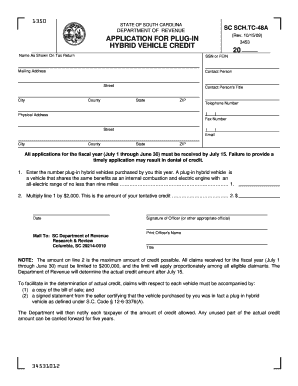

- In the section labeled 'Name As Shown On Tax Return,' enter your full name as it appears on your tax return.

- Provide your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field.

- Next, fill in your mailing address, including street, city, county, state, and ZIP code.

- Identify a contact person by entering their name and title in the provided fields, along with their contact information including telephone number and fax number.

- Fill out the physical address section, entering the street, city, county, state, and ZIP code.

- Indicate the number of plug-in hybrid vehicles you purchased during the fiscal year in line 1.

- Calculate the tentative credit by multiplying the number of vehicles from line 1 by $2,000, and write this amount on line 2.

- Sign the form in the designated area, and print the name and title of the officer completing the application.

- Once you have reviewed the form for accuracy, save your changes, and you can choose to download, print, or share the completed form.

Complete your APPLICATION FOR PLUG-IN HYBRID VEHICLE CREDIT 20 - Sctax online today!

To claim the EV tax credit, you need to purchase a qualifying electric vehicle, obtain a letter of certification from the dealership, fill out IRS Form 8936, and look for state rebates and credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.