Loading

Get St-10 - The South Carolina Department Of Revenue - Sctax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-10 - The South Carolina Department Of Revenue - Sctax online

Filling out the ST-10 form for the South Carolina Department of Revenue is a streamlined process that can be completed online. This guide will walk you through each section of the form to ensure you provide all necessary information accurately.

Follow the steps to complete your ST-10 application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

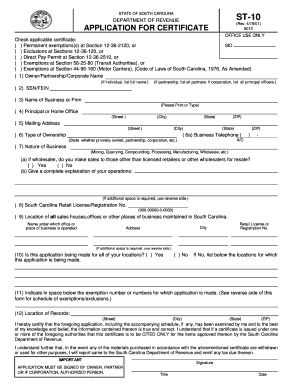

- Begin with the certificate selection. Indicate the applicable certificate type by checking the corresponding box. Options include permanent exemptions, exclusions, direct pay permits, and various other exemptions.

- In section (1), enter the owner, partnership, or corporate name. If you are filling this out as an individual, provide your full name. For partnerships and corporations, list all partners or principal officers accordingly.

- For section (2), input your Social Security Number or Federal Employer Identification Number as required.

- In section (3), specify the name of your business or firm. Ensure that this is printed or typed clearly.

- Complete the address in section (4) for the Principal or Home Office, including street, city, state, and ZIP code.

- Provide your mailing address in section (5) if it differs from the principal address. Include street, city, and state details.

- In section (6), select the type of ownership. Indicate if it is privately owned, a partnership, corporation, etc. Additionally, provide a business telephone number in section (6a).

- Detail the nature of your business in section (7). Clearly describe your business activities such as mining or manufacturing and indicate if you sell to non-retail entities.

- If applicable, provide your South Carolina Retail License or Registration Number in section (8).

- In section (9), list the location of all sales houses, offices, or other places of business maintained in South Carolina. Include the name under which they operate, city, address, and license numbers.

- Answer section (10) by indicating if the application covers all your locations.

- Indicate the exemption number(s) in section (11) for which you are applying. Refer to the reverse side of the form if you need clarification on exemptions.

- Provide the location of your records in section (12), completing the street, city, state, and ZIP code.

- Sign the form, ensuring that the signature is from the owner, a partner, or an authorized person from the corporation. Include the title and date of signing.

- Once all sections are completed, you can save changes, download, print, or share the form electronically.

Complete your ST-10 application online today for a smooth filing experience.

Related links form

Line 10(d): Attach the I-385 if claiming the refundable Motor Fuel Income Tax Credit. The allowable credit is the lesser of the increase in South Carolina Motor Fuel User Fee you paid during the tax year, or the preventative maintenance costs you incurred in South Carolina during the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.