Loading

Get Ri Installment Agreement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Installment Agreement Form online

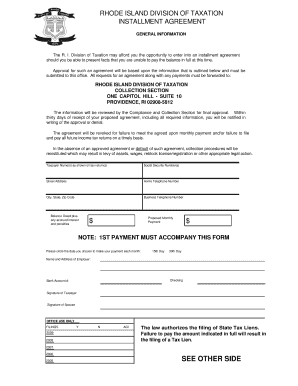

Filling out the Ri Installment Agreement Form online can streamline your request for an installment payment plan with the Rhode Island Division of Taxation. This guide will provide clear, step-by-step instructions to help you successfully complete the form and submit it with confidence.

Follow the steps to fill out the Ri Installment Agreement Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer name(s) as shown on your tax return(s). This ensures that the agreement is filed under the correct identity.

- Provide your Social Security Number(s). This information is crucial for identification purposes.

- Fill in your complete street address, including city, state, and zip code. Ensure all details are accurate to avoid processing delays.

- Add your home and business telephone numbers for contact purposes. Make sure these are current.

- Indicate the total balance owed, including any accrued interest and penalties. Be honest and precise to facilitate the approval process.

- Propose a monthly payment amount that you believe you can manage, and ensure it meets any minimum requirements specified by the Division of Taxation.

- Select and circle the date you prefer to make your monthly payment: the 15th or the 30th of each month.

- Provide the name and address of your employer. This information may be relevant for income verification.

- Enter your checking bank account number. This may be used for automatic withdrawals if applicable.

- Sign the form where indicated. If applicable, have your spouse also sign to validate the agreement.

- Complete the income/expense statement and balance sheet by listing your monthly income, expenses, assets, and liabilities accurately.

- Review the form for completeness and accuracy before submission. Ensure you have attached your first payment, if required.

- Save your changes, download, print, or share the form as needed before submitting it to the Rhode Island Division of Taxation.

Take the first step towards managing your tax payments by completing the Ri Installment Agreement Form online today.

Related links form

The tax must be paid by the seller, grantor, assignor, transferor or person making the conveyance or vesting, unless there is an agreement with the purchaser, or person receiving the conveyance, to the contrary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.