Loading

Get Joint Returns - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

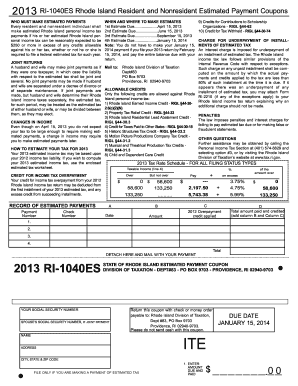

How to fill out the JOINT RETURNS - Tax Ri online

This guide provides step-by-step instructions for completing the JOINT RETURNS - Tax Ri online. Whether you are new to tax filing or looking for a refresher, this resource aims to empower you with the knowledge needed to navigate the process smoothly.

Follow the steps to fill out the JOINT RETURNS - Tax Ri form online.

- Click ‘Get Form’ button to obtain the JOINT RETURNS - Tax Ri form and open it in the editor.

- Begin by entering your information in the designated fields. This includes your name, address, and Social Security numbers for both you and your partner if applicable.

- In the income section, provide details about your modified federal adjusted gross income. Ensure that this information is accurate as it influences your estimated tax.

- Next, proceed to the exemption section. Calculate your exemptions based on your household situation and record them as instructed.

- Fill out the standard deduction amount according to the guidelines provided, ensuring to reference the right deduction worksheet for your filing status.

- Calculate your taxable income by subtracting your exemptions and standard deduction from your modified federal adjusted gross income.

- Use the tax rate schedule to compute your estimated tax based on your taxable income, or alternatively refer to your previous year's tax figure, whichever is lower.

- If applicable, enter any Rhode Island credits that you are eligible for, ensuring to attach any required documentation or forms.

- Once all fields are accurately filled, review the form thoroughly for any errors or omissions.

- Lastly, save changes to the form, and you will have the option to download, print, or share it accordingly.

Ready to file your JOINT RETURNS - Tax Ri online? Complete your document today!

You usually must be married to file together. However, if you are non-married but want to file a joint return, it is possible you can use married filing jointly if you're considered married under a common law marriage recognized by either of these: The state where you live.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.