Loading

Get Research And Development Tax Credit And Instructions For Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Research and Development Tax Credit and Instructions for Tax online

Completing the Research and Development Tax Credit form online can be a straightforward process if you break it down into manageable steps. This guide will provide you with clear instructions and helpful tips for filling out the form accurately and efficiently.

Follow the steps to successfully complete the tax credit form online.

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- Fill in your name as shown on your tax return in the designated field.

- Enter your Federal ID Number, ensuring it is accurate and complete.

- Provide your New Jersey Corporation Number in the appropriate area.

- Read the instructions carefully before proceeding with the completion of the form.

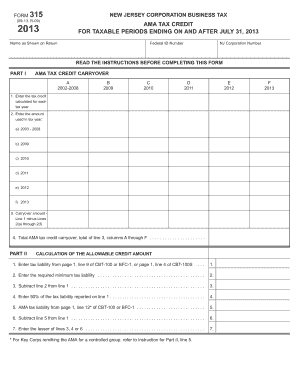

- In Part I, list the AMA tax credit carryover amounts for the years 2002 through 2012 in the specified columns.

- Complete each line for the tax credit calculated and the amounts used for each tax year.

- In Part II, enter your current tax liability and required minimum tax liability per the instructions.

- Calculate the allowable credit by following through the calculation steps outlined in Part II.

- After completing Part II, check all calculations to ensure accuracy.

- Once all fields are filled, you can save changes, download, print, or share the completed form.

Start filling out your Research and Development Tax Credit form online today!

Accounting Treatment for the R&D Credit That means that the 130% R&D relief on your qualifying expenditures is deducted in your Corporation Tax Computation. The tax due on the adjusted profit is then shown in your Profit & Loss account (Income statement).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.