Loading

Get Irs W2 C4267 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs W2 C4267 Form online

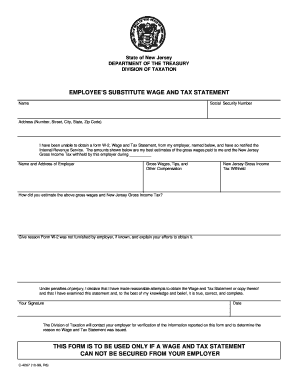

Filling out the Irs W2 C4267 form online can seem daunting, but with clear guidance, you can complete it accurately. This form is essential for individuals who have not received a W-2 from their employer and need to provide estimated wage and tax information.

Follow the steps to complete the Irs W2 C4267 form with ease.

- Press the ‘Get Form’ button to access the Irs W2 C4267 form and open it in your preferred online editor.

- Enter your name as it appears on your identification documents in the designated field for 'Name.'

- Provide your Social Security number in the appropriate section, ensuring accuracy to avoid any tax complications.

- Fill in your mailing address, including the number, street, city, state, and zip code in the 'Address' section.

- Indicate the name and address of your employer who failed to furnish the W-2 form in the specified fields.

- Estimate the gross wages, tips, and other compensation you received from this employer during the indicated time frame, and enter this figure in the relevant field.

- Record the amount of New Jersey Gross Income Tax withheld by your employer, as best as you can estimate, in the designated section.

- Explain how you arrived at your estimated gross wages and New Jersey Gross Income Tax in the provided area, offering any necessary details.

- If known, state the reason why Form W-2 was not provided by your employer and note any efforts you made to obtain it.

- Sign and date the form in the designated fields to declare that the information is true, correct, and complete to the best of your knowledge.

- Once you have filled out the form, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online to ensure accurate tax filing and compliance.

What is a form W-2C? A W-2C is a form used to make corrections on previously issued wage/tax information (W-2s) from current or prior years. Like Form W-2, it is a multi-use form used to report corrected wages to the IRS (Internal Revenue Service), FTB (Franchise Tax Board), and SSA (Social Security Administration).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.