Loading

Get Local Property Form - I.s. (initial Statement) - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Local Property Form - I.S. (Initial Statement) - State Of New Jersey - State Nj online

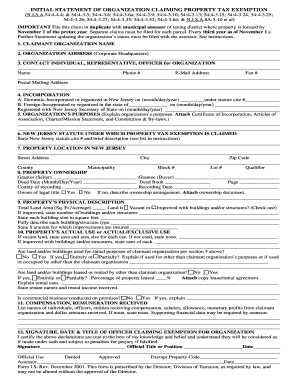

Filling out the Local Property Form - I.S. is essential for organizations seeking a property tax exemption in New Jersey. This guide will provide you with a clear, step-by-step approach to completing the form online, ensuring that you accurately represent your organization and its eligibility.

Follow the steps to complete your Local Property Form - I.S. online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the claimant organization name in the designated field. Ensure this name matches the organization’s legal name.

- Provide the organization address, which should be the corporate headquarters, ensuring accuracy in all details.

- Fill in the contact individual’s details, including their name, phone number, email address, and fax number. Make sure all contact information is current.

- State whether the organization is incorporated domestically in New Jersey or incorporated in another state, and provide the relevant incorporation dates and statutes as required.

- Outline your organization’s purposes in the specified section. Remember to attach required documents like the Certificate of Incorporation.

- Specify the New Jersey statute under which you are claiming property tax exemption, including the statute citation and a brief description.

- Input the property location details, including street address, city, zip code, county, municipality, block number, lot number, and qualifier.

- Detail the property ownership information, including grantor and grantee names, deed date, deed book, and county of recording. Indicate whether your organization holds legal title.

- Describe the physical attributes of the property, including total land area, whether the land is vacant or improved, and the size and type of any structures.

- State the actual use of the property, including whether the land and buildings are utilized for the organization’s purposes.

- List any compensation received by individuals or entities associated with the organization, detailing the amounts.

- Sign and date the form, indicating your official title or position. Confirm that all information provided is true to the best of your knowledge.

- After completing the form, review your entries for accuracy. Save changes, download a copy for your records, print, or share the completed form as needed.

Complete the Local Property Form - I.S. online now and ensure your organization is set for property tax exemption.

New Jersey exit tax exemptions If you remain a New Jersey resident, you'll need to file a GIT/REP-3 form (due at closing), which will exempt you from paying estimated taxes on the sale of your home. Instead, any applicable taxes on sales gains are reported on your New Jersey Gross Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.