Loading

Get Txr-02 01 Consumer Use Tax Return-7-1-06.xls. Introduced Graduated Penalty And Interest Rates.form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TXR-02 01 Consumer Use Tax Return-7-1-06.xls. Introduced Graduated Penalty And Interest Rates.Form online

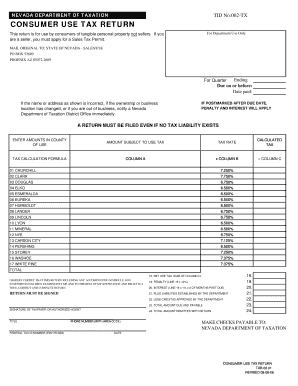

Filling out the TXR-02 01 Consumer Use Tax Return is essential for individuals who consume tangible personal property in Nevada. This guide will provide clear, step-by-step instructions on completing the form, ensuring a smooth filing process.

Follow the steps to accurately complete the consumer use tax return form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- In the designated section for ‘Amount Subject to Use Tax,’ input the total purchase price of the tangible personal property you have acquired without the payment of Nevada tax.

- For each corresponding county, provide the calculated tax by multiplying the amount entered in Column A by the applicable tax rate in Column B. Record this value in Column C.

- Sum all values in Column C and enter the total on Line 18.

- If your return is postmarked after the due date, calculate a 10% penalty by multiplying the total on Line 18 by 0.10, and record this value on Line 19.

- Calculate the interest for late payment by determining 1% of the total on Line 18 for each month overdue. Enter this amount on Line 20.

- If applicable, enter any previous liabilities established by the Department of Taxation on Line 21.

- Include any credits you may have received from the Department of Taxation on Line 22.

- On Line 23, calculate the total amount due by adding Lines 18, 19, 20, and 21, then subtracting Line 22.

- Finally, enter the total amount you are remitting with this return on Line 24, and remember to sign the form at the designated area.

Completely fill out and submit your consumer use tax return form online to ensure compliance and avoid penalties.

Generally, a bank must make the first $225 from the deposit available—for either cash withdrawal or check writing purposes—at the start of the next business day after the banking day that the deposit is made. The rest of the deposit should generally be available on the second business day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.