Get Nebraska Fillable Schedule I Form 1040n

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Fillable Schedule I Form 1040n online

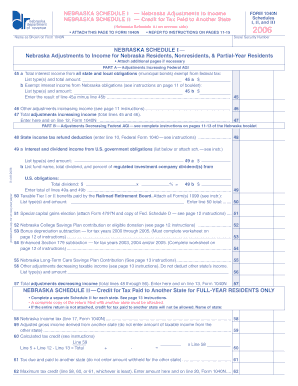

This guide provides clear, step-by-step instructions for filling out the Nebraska Fillable Schedule I Form 1040n online. Whether you are a resident, nonresident, or partial-year resident, this document will help you accurately complete the necessary adjustments to your income.

Follow the steps to complete the Nebraska Fillable Schedule I Form 1040n online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as shown on Form 1040N in the designated field at the top of the form.

- Provide your Social Security Number in the appropriate field.

- Begin with Part A, where you will list total interest income from all state and local obligations exempt from federal tax. Enter the types and total amounts in line 45a.

- For line 45b, list exempt interest income specifically from Nebraska obligations as instructed.

- Subtract the amount in line 45b from line 45a and enter the result on line 45.

- Complete line 46 for any other adjustments that increase your income, as outlined in the instructions.

- Total the adjustments increasing your income by calculating line 45 plus line 46 and enter this on line 47.

- Proceed to Part B to account for adjustments that decrease federal Adjusted Gross Income (AGI). Begin by entering any state income tax refund deduction in line 48.

- List any interest and dividend income from U.S. government obligations in line 49a.

- If applicable, enter the total dividend and percentage of regulated investment company dividends in line 49b.

- Add lines 49a and 49b and enter the result on line 49.

- Continue filling out the remaining lines in Part B, including any special claims for capital gains or contributions to a Nebraska College Savings Plan.

- Once all adjustments are completed, ensure total adjustments decreasing income are calculated and entered on line 57.

- Review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Begin filling out your Nebraska Fillable Schedule I Form 1040n online today for a seamless tax filing experience.

0:45 6:25 How to Fill Out Form 1040 | Preparing your Taxes 2022 | Money Instructor YouTube Start of suggested clip End of suggested clip Finally you will determine your tax bill or refund. This will tell you whether you have already paidMoreFinally you will determine your tax bill or refund. This will tell you whether you have already paid any or all of the tax.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.