Loading

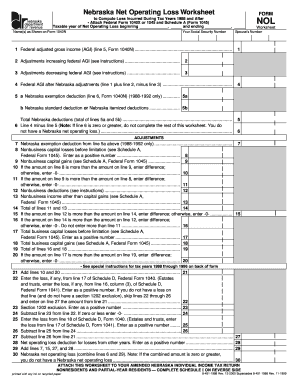

Get Form Nol - Nebraska Net Operating Loss Worksheet - Revenue Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NOL - Nebraska Net Operating Loss Worksheet - Revenue Ne online

This guide provides a comprehensive overview of filling out the Form NOL - Nebraska Net Operating Loss Worksheet online. It is designed to assist users in accurately completing each section of the form to ensure a smooth filing process.

Follow the steps to complete the Form NOL online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your name as it appears on Form 1040N and your Social Security number at the top of the form.

- For line 1, provide your federal adjusted gross income. This figure can be found on line 5 of Form 1040N.

- In line 2, enter any adjustments that increase your federal AGI. Refer to the specific instructions for guidance on what entries may qualify.

- For line 3, provide any adjustments that decrease your federal AGI. Ensure that you reference the instructions to make accurate entries.

- Calculate line 4 by adding lines 1 and 2, then subtracting line 3 from the total. This is your federal AGI after Nebraska adjustments.

- Complete lines 5a and 5b with the correct Nebraska exemption deduction and standard or itemized deductions.

- Subtract line 5 from line 4 to get line 6. If this amount is zero or greater, do not continue with the worksheet as it indicates no Nebraska net operating loss.

- Proceed to the adjustments section. Enter the amounts in lines 7 through 30 as directed, following the specific instructions for entering capital gains, losses, and deductions.

- After completing the worksheet, review all entries for accuracy.

- At the end, you can save your changes, download the form, print it, or share it as needed.

Start filling out your Form NOL online today to maximize your tax benefits.

Nebraska Tax Rates, Collections, and Burdens Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.