Loading

Get Form 51, Nebraska Lottery/raffle Tax Return - Revenue Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 51, Nebraska Lottery/Raffle Tax Return - Revenue Ne online

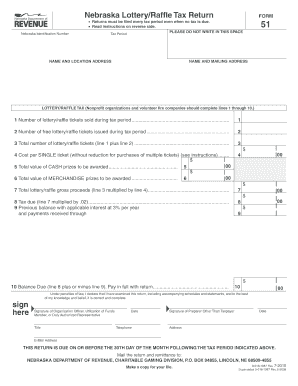

Filling out the Form 51, Nebraska Lottery/Raffle Tax Return - Revenue Ne is essential for nonprofit organizations and volunteer fire companies conducting lottery or raffle activities. This guide provides clear and supportive instructions for completing the form online, ensuring that users can navigate each section with ease.

Follow the steps to complete the Nebraska Lottery/Raffle Tax Return online.

- Press the ‘Get Form’ button to access the document and open it in your online editor.

- Enter the Nebraska identification number in the designated field as indicated on the form.

- Record the tax period to which this return applies, following the instructions provided.

- Fill in your organization’s name and mailing address in the correct sections.

- Indicate the number of lottery/raffle tickets sold during the tax period on line 1.

- Document the number of free lottery/raffle tickets issued during the tax period on line 2.

- Calculate the total number of lottery/raffle tickets (sum of line 1 and line 2) on line 3.

- Enter the cost per single ticket, as stated in the instructions, in line 4.

- Provide the total value of cash prizes to be awarded on line 5.

- List the total value of merchandise prizes to be awarded on line 6.

- Calculate the total lottery/raffle gross proceeds by multiplying line 3 by line 4 and enter this amount on line 7.

- Calculate the tax due by multiplying the amount on line 7 by 0.02 and write it on line 8.

- Check line 9 for any previous balances with applicable interest and payments received.

- Calculate the balance due by adding or subtracting the amount on line 9 from line 8 and enter it on line 10.

- Sign and date the form where indicated by an authorized organization representative.

- Ensure that the preparer, if not the taxpayer, also signs the form along with their title and contact information.

- After completing the form, save any changes, download, print, or share the document as required.

Submit your completed Form 51 online to ensure compliance with Nebraska Lottery/Raffle tax regulations.

You must file a Nebraska tax return if you are required to file a federal tax return. You have at least $5,000 of net Nebraska adjustments to your federal adjusted gross income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.