Loading

Get File Form 2441n Only If You Do Not File Federal Form 2441 Or Form 1040a, Schedule 2 - Revenue Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the File Form 2441N only if you do not file Federal Form 2441 or Form 1040A, Schedule 2 - Revenue Ne online

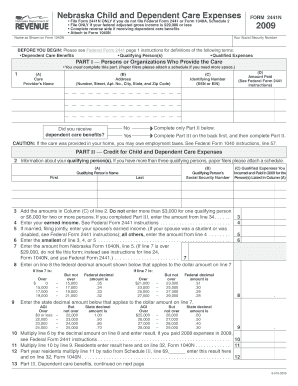

Filling out Form 2441N is essential for individuals whose federal adjusted gross income is $29,000 or less and who do not file Federal Form 2441 or Form 1040A, Schedule 2. This guide provides detailed, step-by-step instructions to help you navigate the form with confidence.

Follow the steps to complete your Form 2441N online.

- Click 'Get Form' button to obtain the form and open it for editing.

- Enter your name as shown on Form 1040N in the designated field at the top of the form.

- Provide your Social Security Number as required.

- In Part I, list all persons or organizations that provided care. Include their name, address, and identifying number.

- Indicate whether you received dependent care benefits. If you did, complete Part III first; if not, proceed directly to Part II.

- In Part II, enter the names and Social Security Numbers of your qualifying persons.

- Add the total amounts you paid for care in column (C), ensuring not to exceed the maximum allowable ($3,000 for one qualifying person or $6,000 for two or more).

- Enter your earned income, your spouse's earned income if applicable, and follow the instructions provided for calculating the credit.

- In Part III, provide details about dependent care benefits received, including amounts from W-2 forms, if applicable.

- Follow the instructions for determining any amounts that are exempt from taxes and complete the required calculations.

- Once all sections are completed, save your changes and prepare to download, print, or share the form as needed.

Complete and submit your Form 2441N online to ensure you receive the benefits you are eligible for.

$8,000 (previously $3,000) for one qualifying child or up to. $16,000 (previously $6,000) for two or more qualifying children.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.