Loading

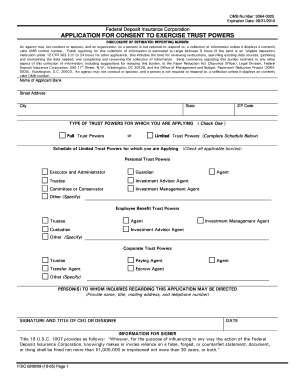

Get Fdic 6200/09, Application For Consent To Exercise Trust Powers - Ndbf Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FDIC 6200/09, Application For Consent To Exercise Trust Powers - Ndbf Ne online

This guide provides clear instructions on completing the FDIC 6200/09 form, which is essential for banks seeking approval to exercise trust powers. By following these step-by-step instructions, users can effectively navigate the application process online.

Follow the steps to complete the FDIC 6200/09 form online.

- Press the ‘Get Form’ button to obtain the FDIC 6200/09 form and open it for editing.

- Fill out the applicant bank's details including the name, street address, city, state, and ZIP code in the designated fields.

- Select the type of trust powers for which you are applying by checking either 'Full Trust Powers' or 'Limited Trust Powers.' If applying for limited trust powers, complete the corresponding schedule by checking all applicable boxes.

- Provide the contact information of the individual(s) to whom inquiries regarding the application may be directed, including their name, title, mailing address, and telephone number.

- Ensure the CEO or their designee signs and dates the application in the designated area. This confirms the validity of the application.

- Review the specific instructions section carefully and complete all required information, such as the adoption of the Statement of Principles and details regarding trust officer qualifications.

- If you are an eligible depository institution, include the cover page and complete items 1 through 4 for expedited processing. If not, ensure all required sections are complete.

- Ensure all responses are complete, accurate, and include any necessary explanations for answers like 'none,' 'not applicable,' or 'unknown.'

- Once you have reviewed and completed your application, you can save your changes, download a copy, print the form, or share it as necessary.

Complete your FDIC 6200/09 application online today to streamline the process.

The Bank Secrecy Act is officially called the Currency and Foreign Transactions Reporting Act, started in 1970. It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.