Loading

Get Schedule K-1 Form 720s Ky Shareholders Share - Kentucky ... - Revenue Ky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule K-1 Form 720S KY Shareholders Share - Kentucky online

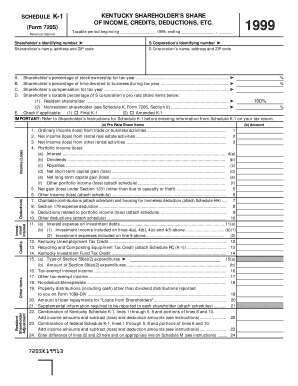

The Schedule K-1 Form 720S is essential for S corporation shareholders in Kentucky to report their share of the corporation's income, credits, deductions, and other financial details. This guide provides clear and concise instructions for completing the form accurately online.

Follow the steps to complete Schedule K-1 Form 720S online:

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the taxable period by entering the beginning and ending dates in the designated fields.

- Input the shareholder's identifying number and name, along with their address and ZIP code in the appropriate fields.

- Provide the S corporation's identifying number and name, along with their address and ZIP code.

- Enter the shareholder's percentage of stock ownership for the tax year, along with the percentage of time devoted to business.

- List the shareholder's compensation for the tax year in the designated section.

- Indicate whether the shareholder is a resident or nonresident shareholder by checking the appropriate box.

- Complete the Pro Rata Share Items section by entering income, deductions, credits, and other financial items as they apply.

- Ensure all attached schedules are included, especially if indicated, and complete the necessary calculations as directed.

- Review all entries for accuracy before saving any changes, followed by downloading, printing, or sharing the completed form.

Start filling out your Schedule K-1 Form 720S online today to ensure accurate reporting.

Kentucky LLCs, like all LLCs, are taxed as pass-through entities by default, which means you report your LLC's profits and losses on your individual tax returns. In Kentucky, the personal net income tax rate you'll pay is a flat 5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.