Get Form Pte Wh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Pte Wh online

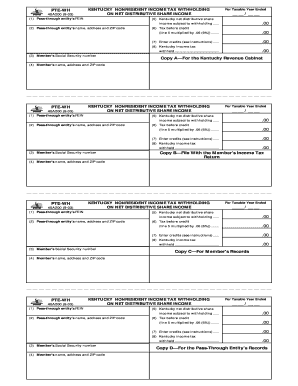

Filling out Form Pte Wh is essential for nonresident individuals receiving distributive income from a pass-through entity in Kentucky. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently online.

Follow the steps to fill out Form Pte Wh easily and accurately.

- Press the ‘Get Form’ button to access the form online and open it in your preferred document viewer.

- Enter the pass-through entity’s Federal Identification Number (FEIN) in the designated field.

- Provide the pass-through entity’s name, address, and ZIP code in the appropriate section.

- Input the member’s Social Security number where requested.

- Fill in the member’s name, address, and ZIP code in the corresponding fields.

- Indicate the member’s net distributive share income subject to withholding, derived from Schedule K-1, making necessary calculations.

- Multiply the amount from step 6 by 6%, then enter this amount as the tax before credit.

- Subtract any credits the member can reasonably expect to claim during the year from the amount in step 7.

- Calculate the final Kentucky income tax withheld by subtracting the total from step 8 from the total in step 7.

- Once all fields are completed, save your changes, and you may choose to download, print, or share the completed form.

Complete your documents online for a hassle-free experience.

To fill out a W-2 form correctly, start by entering your employer's information, including their identification number. Next, provide your personal information, such as your name, address, and Social Security number. Ensure that all amounts, including wages and taxes withheld, are accurate, as this form is essential for your tax return. If you need assistance with tax forms, consider using platforms like USLegalForms, which offer guidance and templates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.