Loading

Get Idaho Nonresident Owner Agreement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho Nonresident Owner Agreement Form online

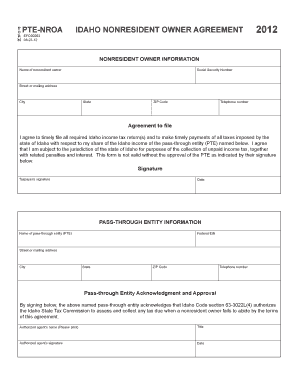

The Idaho Nonresident Owner Agreement Form is a crucial document for nonresident owners of pass-through entities who need to comply with Idaho tax regulations. This guide provides comprehensive and user-friendly steps to assist you in filling out the form online with ease.

Follow the steps to complete the Idaho Nonresident Owner Agreement Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Nonresident Owner Information' section, provide your Social Security Number, name, street or mailing address, city, state, ZIP code, and telephone number.

- In the 'Agreement to file' section, check the box indicating your agreement to timely file all required Idaho income tax returns and make timely payments of all taxes imposed by the state of Idaho.

- Sign and date the form in the field provided for the taxpayer's signature.

- Move to the 'Pass-Through Entity Information' section and fill in the Federal Employer Identification Number (EIN), the name of the pass-through entity, street or mailing address, city, state, ZIP code, and telephone number.

- In the 'Pass-Through Entity Acknowledgment and Approval' section, have the authorized agent print their name, title, and provide their signature along with the date.

- Once all sections are complete, review the form for accuracy, then save your changes. You can also download, print, or share the form as needed.

Start completing your Idaho Nonresident Owner Agreement Form online today.

You must file individual income tax returns with Idaho if you're any of the following: An Idaho resident. A part-year Idaho resident with income from Idaho sources or income earned while an Idaho resident. A nonresident of Idaho with income from Idaho sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.