Loading

Get Idaho Form Pte 12 Instructions 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho Form PTE 12 Instructions 2014 online

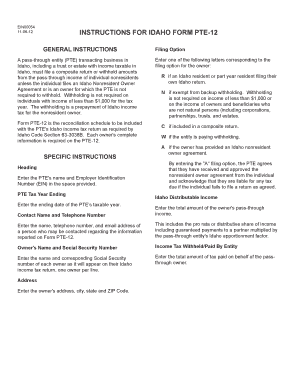

Filing the Idaho Form PTE 12 is essential for pass-through entities conducting business in Idaho. This guide provides simple, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the Idaho Form PTE 12 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred format.

- In the heading section, enter the pass-through entity's (PTE) name and Employer Identification Number (EIN) in the designated spaces.

- For the PTE tax year ending, specify the ending date of the entity's taxable year.

- Select a filing option by entering the corresponding letter for the owner: 'R' for Idaho residents, 'N' for exempt from backup withholding, 'C' for composite return, 'W' if the entity is paying withholding, or 'A' if the owner has provided a nonresident owner agreement.

- When selecting 'A', the PTE confirms receipt and approval of the nonresident owner agreement and agrees to take responsibility for any taxes due if the individual fails to file their return.

- Input the total amount of the owner's pass-through income under Idaho distributable income.

- Provide the name, telephone number, and email address of a contact person regarding the information on Form PTE 12.

- List each owner's name and Social Security number as it must appear on their Idaho income tax return. Enter one owner per line.

- Indicate the total amount of tax withheld or paid by the entity on behalf of the pass-through owner.

- Finally, enter the owner's complete address, including city, state, and ZIP code.

- Once all fields are completed, save your changes, and you can choose to download, print, or share the form as needed.

Complete your Idaho Form PTE 12 online today to ensure compliance with state tax requirements!

P.O. Box 56 is the mailing address for the Idaho State Tax Commission, specifically for submitting tax forms and payments. This address is essential for timely processing of your documents. For further details, including filing tips, refer to the Idaho Form Pte 12 Instructions 2014.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.