Get Schedule Ge

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Ge online

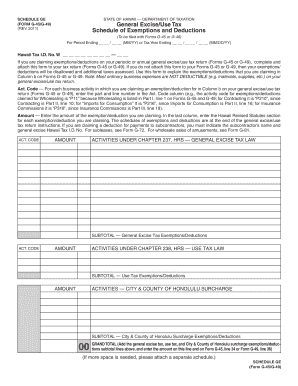

Filling out the Schedule Ge is an essential step in claiming exemptions and deductions for your general excise/use tax return in Hawaii. This guide provides you with clear, step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to successfully complete your Schedule Ge online.

- Press the ‘Get Form’ button to access the Schedule Ge form and open it in your editor.

- Enter the period ending date or tax year ending date in the designated fields, as required.

- Input your Hawaii Tax I.D. number in the appropriate section, ensuring correct entry.

- For each exemption or deduction you are claiming, identify the business activity and enter the corresponding Act. Code from your Forms G-45 or G-49 in the Act. Code column.

- Specify the amount of each exemption or deduction you are claiming next to the Act. Code.

- In the last column, indicate the relevant section from the Hawaii Revised Statutes for each exemption or deduction claimed.

- If claiming deductions for payments to subcontractors, list the subcontractor’s name and their Hawaii Tax I.D. number.

- If additional space is needed, attach a separate schedule with the required information.

- Once all fields are completed, review your entries for accuracy.

- Save your changes, and you can download, print, or share the completed form as necessary.

Take the necessary steps to file your Schedule Ge online today for a smoother tax process.

Related links form

To properly fill out a tax withholding form, begin by entering your personal information, including your name and Social Security number. Next, indicate your filing status and the number of allowances you wish to claim. Be sure to review the form for accuracy before submission. If you need additional support, US Legal Forms can provide templates and instructions to help you complete your Schedule Ge correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.