Loading

Get Gew Ta Rv 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gew Ta Rv 1 online

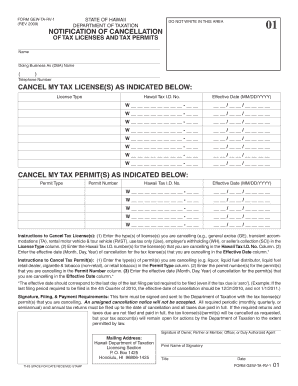

This guide will help you navigate the Gew Ta Rv 1 form required for notifying the cancellation of tax licenses and permits in Hawaii. Follow these instructions to complete the form accurately and efficiently.

Follow the steps to successfully complete the Gew Ta Rv 1 form.

- Click the ‘Get Form’ button to obtain the Gew Ta Rv 1 form and access it in the online editor.

- Begin by entering your name in the designated field. This should reflect your legal name as it appears on official documents.

- In the ‘Doing Business As (DBA) Name’ section, enter the name under which your business operates, if applicable. Leave this blank if not relevant.

- Provide your telephone number in the corresponding field. Ensure this is a direct line where you can be reached.

- In the section labeled ‘CANCEL MY TAX LICENSE(S) AS INDICATED BELOW,’ fill in the ‘License Type’ for each tax license you wish to cancel, such as general excise or transient accommodations.

- For each license type listed, input the corresponding Hawaii Tax I.D. number in the appropriate column.

- Enter the effective date of cancellation for each tax license in the specified format (MM/DD/YYYY). Make sure this aligns with the last filing period for which you were responsible.

- Proceed to the section labeled ‘CANCEL MY TAX PERMIT(S) AS INDICATED BELOW.’ Here, repeat steps 5 to 7 for any permits you are cancelling.

- Review all entries to ensure accuracy and completeness. Corrections may be necessary to avoid delays.

- Once you have verified all information, you may proceed to save your changes, download, print, or share the completed form as needed.

Complete your documents online with confidence and ensure your tax licenses and permits are properly canceled.

To apply for a GE tax license in Hawaii, you need to complete an application form, which is available online. You can submit this application either in person or by mail to the Department of Taxation. The Gew Ta Rv 1 can guide you through the necessary steps to ensure your application is complete. Additionally, US Legal Forms offers templates and forms to simplify this process, making it easier for you to obtain your license.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.