Loading

Get 104ep

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 104ep online

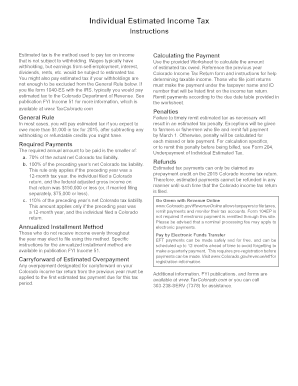

Filling out the 104ep form online is an essential step for individuals making estimated income tax payments. This guide provides you with clear, user-friendly instructions to help you navigate through the process effectively.

Follow the steps to successfully complete your 104ep form online.

- Press the ‘Get Form’ button to access the 104ep form.

- Begin by entering your personal details, including your full name and contact information, in the designated fields of the form.

- Fill out the estimated income section to calculate your projected annual income. This includes income from self-employment, interest, dividends, and any renting income.

- Complete any additional fields related to deductions or credits that may apply to your situation, ensuring you have all relevant information at hand.

- Review all the entered information for accuracy before submitting, as incorrect details can lead to penalties.

- Once satisfied with the form, you can save your changes, download the completed form, print it out for your records, or share it as necessary.

Start filling out your 104ep form online today to ensure your estimated tax payments are submitted on time.

The easiest way to file Form 1040 is to use online tax software or a tax professional. These options provide step-by-step guidance and help ensure that you don’t miss any important details. Additionally, online filing often allows for faster processing and quicker refunds. Consider uslegalforms for user-friendly resources that can help you navigate the filing process effortlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.