Get Form 199 General Instructions 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 199 General Instructions 2012 online

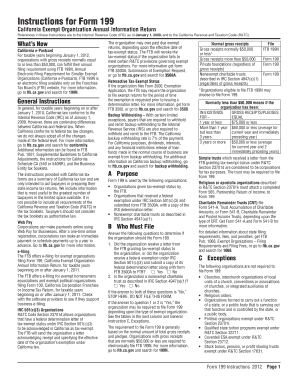

Filling out Form 199, the California Exempt Organization Annual Information Return, can seem overwhelming. This guide aims to provide a clear and comprehensive set of instructions to help you navigate the required sections and fields effectively, enabling you to complete the form online with confidence.

Follow the steps to fill out Form 199 online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the accounting period information at the top of the form, specifying the taxable year including the month, day, and year.

- Enter the required entity information, ensuring to fill in your California corporation number, Federal Employer Identification Number, legal name of the organization, and mailing address.

- Proceed to Questions A through O, answering each question carefully based on your organization's status. Attach additional schedules as necessary for specific questions.

- Complete Part I, outlining gross receipts, contributions, gifts, and similar amounts. Refer to General Instruction E for definitions and guidelines.

- Fill out Part II if your organization is required. If not, attach a completed copy of federal Form 990 or Form 990-PF, as appropriate.

- Review the instructions regarding payments and filing fees. Remember that a $10 fee is required for filing Form 199 unless your organization is exempt.

- Once all required fields are completed and information is verified, choose to save changes, download the form, or print for your records. Ensure it is submitted by the designated deadline.

Start filling out your Form 199 online today to meet all necessary reporting requirements.

Related links form

You can file Form 199 with the California Franchise Tax Board, either by mailing it to their designated address or through their online filing system. It is essential to check for any specific mailing addresses based on your organization's details. For the most accurate filing information, refer to the Form 199 General Instructions 2012, which provides the necessary addresses and further details.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.