Get Ca Form 5806

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca Form 5806 online

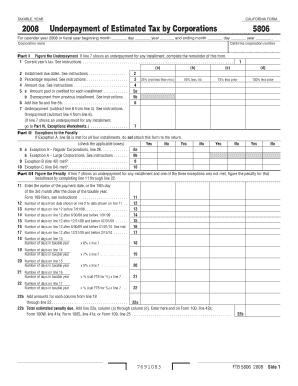

The Ca Form 5806 is used to determine if a corporation has underpaid estimated tax and to calculate any applicable penalties. This guide will provide a clear, step-by-step approach to completing the form online, ensuring all users can accurately fulfill their tax obligations.

Follow the steps to complete the Ca Form 5806 online effectively.

- Use the ‘Get Form’ button to access the Ca Form 5806. This will allow you to open the form in an online editor.

- Enter the taxable year at the top of the form. For the current form, indicate the year 2008 or the fiscal year as required.

- Fill in the corporation name and the California corporation number in the designated fields.

- Navigate to Part I and input the current year’s tax in line 1, following the instructions provided.

- Fill in the installment due dates in Part I, line 2, ensuring they correspond to the correct months.

- Complete line 3 by entering the corresponding required percentages based on the instructions.

- In line 4, calculate and enter the amounts due for each installment.

- Record the amount paid or credited for each installment in line 5a and any overpayments from previous installments in line 5b.

- Calculate the total for line 6 by adding lines 5a and 5b together.

- Check line 7 to see if there is an underpayment. If there is, proceed to the relevant sections for exceptions.

- Continue to fill out Parts II and III as necessary, following similar logical steps for exceptions and penalties.

- Once all sections are completed, review the form for accuracy. Save your changes, then download, print, or share the completed form as needed.

Complete your forms online to ensure compliance and efficiency.

CA Form 5806 is a specific tax form used for reporting certain California tax credits and adjustments. It is essential for taxpayers who want to claim specific benefits or adjustments on their California tax returns. Understanding how to properly complete CA Form 5806 can help you maximize your tax benefits. For assistance in filling out this form, uslegalforms offers a range of resources to guide you through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.